- The average check from Uncle Sam hit $3,068 for the week of March 1, reflecting an increase of 0.7 percent year over year.

- This tax season is the first time filers are submitting returns under the Tax Cuts and Jobs Act, an overhaul of the revenue code.

- Unhappy with the results? Now is the time to make changes to your withholding.

With tax season halfway behind us, refunds are edging up slightly from where they were a year ago.

The average check from the IRS hit $3,068 for the week of March 1, up 0.7 percent from this time last year, according to data from the tax authority.

It’s a different story from where things were at the start of the tax filing season, which kicked off Jan. 28. At the time, refunds were down by nearly 9 percent from the prior year — a surprise to some early bird filers.

This spring marks the first time taxpayers are submitting returns under the Tax Cuts and Jobs Act, which went into effect in 2018.

The overhaul of the revenue code nearly doubled the standard deduction to $12,000 for single people ($24,000 for married couples filing jointly), eliminated personal exemptions and placed new caps on itemized deductions.

Be aware: Smaller refunds may not necessarily be bad news. If you’ve overpaid on taxes, you likely are in line for a big refund — but you also took home less pay.

Indeed, the Treasury Department and the IRS updated the tax withholding tables in 2018.

Rep. Kevin Brady, R-Texas, has told CNBC that taxpayers may have seen smaller refunds because they received their money in their paychecks over the year.

He also said that filers can tweak their tax withholding at work using Form W-4.

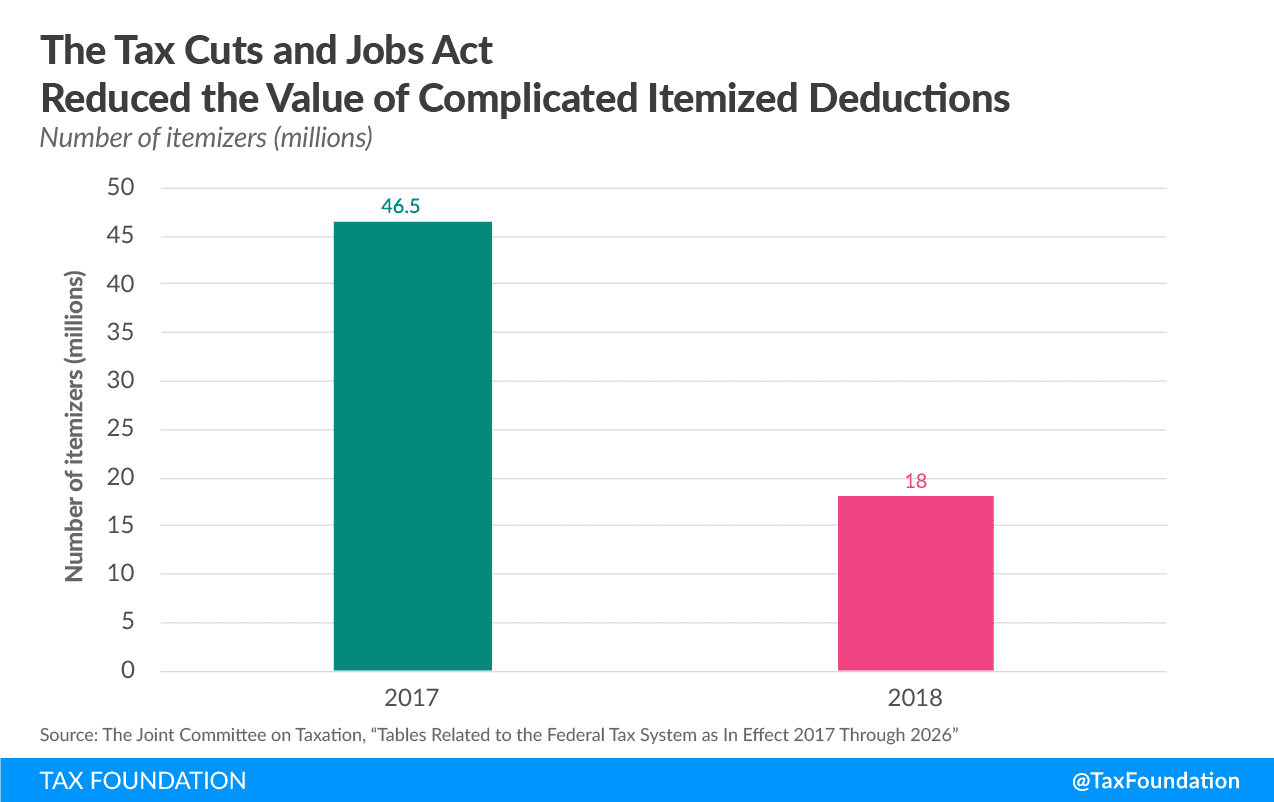

With the higher standard deduction, far fewer people are expected to itemize. About 30 million fewer households are expected to itemize their deductions in 2018, compared with 2017.

Key changes that apply to itemizers for 2018 include a new $10,000 cap on state and local tax deductions, as well as the elimination of miscellaneous itemized deductions.

“The more deductions you lost, the more your taxable income increased,” said Nathan Rigney, lead tax research analyst at the Tax Institute at H&R Block.

On the flip side, families with children have lost the exemptions they can claim for dependents. However, the child tax credit has been doubled to $2,000 for each kid under age 17.

Higher-income households are also now eligible for the child tax credit. This tax break now begins to phase out at $200,000 of modified adjusted gross income for singles, or $400,000 for married couples filing jointly.

In 2017, the child tax credit started to phase out at $75,000 of MAGI (or $110,000 for joint filers).

If you want to compare how you fared in 2018 versus how you did in 2017, remember that your refund is just one consideration.

What you need to consider is how your tax liability stacks up against your income in both years, said Chris Benson, CPA and principal at L.K. Benson & Co. in Towson, Maryland.

Disappointed with this year’s results? Consider taking a second look at your Form W-4 at work so that you can make changes for the 2019 tax year.

“It’s going to happen again if you don’t adjust your withholding right now,” said Cari Weston, CPA and director of tax practice and ethics for the American Institute of CPAs.

Leave A Comment